Medicare Advantage Annual Enrollment 2022

OCTOBER 15, 2021– DECEMBER 7, 2021

When can you join, switch or drop a Medicare Advantage Plan?

You can join, switch or drop a Medicare Advantage Plan at these times:

- Initial Enrollment Period — When you first become eligible for Medicare. The 3 months before you turn age 65 to 3 months after the month you turn age 65.

- Open Enrollment Period — October 15 – December 7 each year. Sometimes called the Annual Election Period or Annual Coordinated Enrollment Period. During this time:

- Anyone with Medicare Parts A & B can switch to a Part C plan.

- Anyone with Medicare Part C can switch back to Parts A & B.

- Anyone who has or is signing up for Medicare Parts A or B can join, drop or switch a Part D prescription drug plan.

- Anyone with Medicare Part C can switch to a new Part C plan.

- Your coverage will start January 1 of the following year.

Request your free Medicare and You to review what is best for you:

- Special Enrollment Period — 1) If you move out of your plan’s service area; 2) if you have both Medicare and Medicaid; 3) if you qualify for low income subsidy (“extra help”); or 4) if you live in an institution (e.g., nursing home). Other situations may qualify you for a special enrollment period.

- Disenrollment Period — Between January 1 – March 31 each year. 1) If you’re in a Medicare Advantage Plan, you can leave your plan and switch to Original Medicare; 2) If you switch to Original Medicare during this period, you’ll have until March 31 to also join a Medicare Prescription Drug Plan to add drug coverage. Your coverage will begin the first day of the month after the plan gets your enrollment form.

What is Medicare?

MEDICARE IS HEALTH INSURANCE FOR:

- People 65 or older

- People under 65 with certain disabilities

- People of any age with End-Stage Renal Disease (ESRD)

(permanent kidney failure requiring dialysis or a kidney transplant)

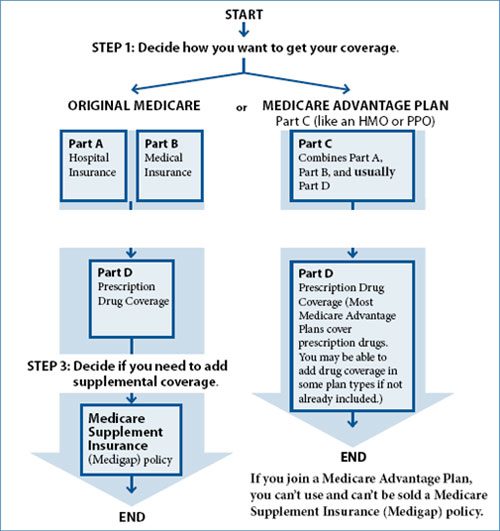

Your Medicare coverage choices at a glance

THE DIFFERENT PARTS OF MEDICARE

What are Medicare Advantage Plans (Part C)?

A Medicare Advantage Plan (like an HMO or PPO) is another way to get your Medicare coverage. If you join a Medicare Advantage Plan, you still have Medicare. You’ll get your Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance) coverage from the Medicare Advantage Plan, not Original Medicare. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies that Medicare approves.

MEDICARE ADVANTAGE PLANS COVER ALL MEDICARE SERVICES –

In all types of Medicare Advantage Plans, you’re always covered for emergency and urgent care. Medicare Advantage Plans must cover all of the services that Original Medicare covers except hospice care and some care in qualifying clinical research studies. Original Medicare covers hospice care and some costs for clinical research studies, even if you’re in a Medicare Advantage Plan.

- Medicare Advantage Plans may offer extra coverage, like vision, hearing, dental, and other health and wellness programs.

- Most Medicare Advantage Plans include Medicare prescription drug coverage (Part D).

- In addition to your Part B premium, you might pay a monthly premium for the Medicare Advantage Plan.

What are the different types of Medicare Advantage Plans?

- Health Maintenance Organization (HMO) plans—In most HMOs, you can only go to doctors, other health care providers, or hospitals in the plan’s network except in an urgent or emergency situation. You may also need to get a referral from your primary care doctor for tests or to see other doctors or specialists.

- Preferred Provider Organization (PPO) plans—In a PPO, you pay less if you use doctors, hospitals, and other health care providers that belong to the plan’s network. You usually pay more if you use doctors, hospitals, and providers outside of the network.

- Private Fee-for-Service (PFFS) plans—PFFS plans are similar to Original Medicare in that you can generally go to any doctor, other health care provider, or hospital as long as they agree to treat you. The plan determines how much it will pay doctors, other health care providers, and hospitals, and how much you must pay when you get care.

- Special Needs Plans (SNPs)—SNPs provide focused and specialized health care for specific groups of people, like those who have both Medicare and Medicaid, live in a nursing home, or have certain chronic medical conditions.

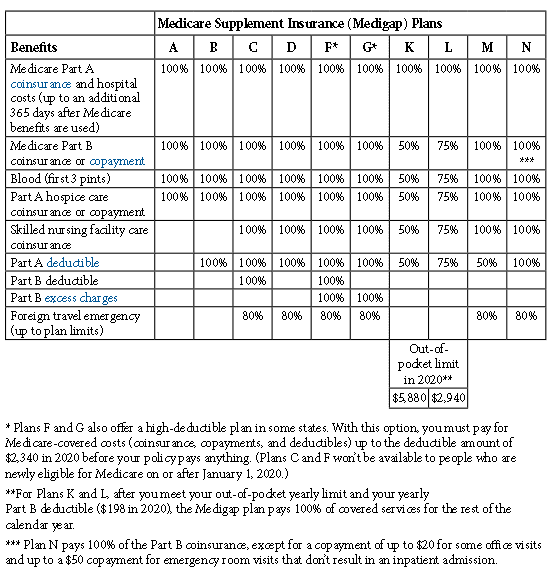

What is Medicare Supplement Insurance ?

Medicare Supplement Insurance policies, sold by private companies, can help pay some of the health care costs that Original Medicare doesn’t cover, like copayments, coinsurance, and deductibles. Medicare Supplement Insurance policies are also called Medigap policies.

Some Medigap policies also offer coverage for services that Original Medicare doesn’t cover, like medical care when you travel outside the U.S. If you have Original Medicare and you buy a Medigap policy, Medicare will pay its share of the Medicare-approved amount for covered health care costs. Then, your Medigap policy pays its share. You have to pay the premiums for a Medigap policy.

WHAT DO MEDICARE SUPPLEMENTS (MEDIGAP) POLICIES COVER ?

Medicare Part D – Prescription Drug Coverage

Part D coverage is offered through private prescription drug plans, or PDPs, which Medicare has approved. Part D coverage may be provided in two ways: a stand-alone plan (fee for service basis) providing prescription drug coverage to Original Medicare, or through a Part C plan that includes prescription drug coverage.

Individual Eligibility and Enrollment

Individuals must meet the following requirements to receive Part D benefits:

- BBe enrolled in Part A and/or Part B

- Enroll in a Part D plan in their service area; if no plan is offered in a service area, a federal standard plan will be provided

Individuals enrolled in Medicaid are automatically covered by Part D.

Individuals have two options for enrolling in a Part D plan:

- During the initial enrollment period for Medicare; or

- During the annual enrollment period for Part D: October 15th through December 7th. Coverage begins on January 1st of the following year.

Part D late enrollment penalty:

- Late enrollment increases the Part D monthly premium for as long as an individual has Part D coverage. Enrolling or changing Part D plans during the initial enrollment period or during the Part D annual enrollment period ensures that a late enrollment penalty is not incurred.